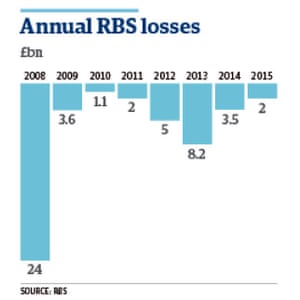

RBS pays chief executive Ross McEwan £3.8m as it reports £2bn loss

Shares slide after bailed-out bank reveals eighth consecutive year of losses

Royal Bank of Scotland has defended a £3.8m pay deal for its chief executive after reporting a £2bn annual loss and falling into the red for the eighth consecutive year.

Shares in the bank slumped as RBS dampened expectations that it will start returning cash to shareholders as soon as the beginning of next year. The shares closed down 7% at 226.6p, below the 502p at which taxpayers break even on their 73% stake.

The pay packet for RBS boss Ross McEwan was the highest for a chief executive of the bank since its 2008 bailout, with 121 employees also receiving more than €1m (£790,000) during the year. The chairman, Sir Howard Davies, said the doubling in pay for McEwan – a New Zealander who took the helm two years ago – was “appropriate and justified”, and pointed out that his peers were earning more.

However, the results for 2015 pushed the bank’s losses since the bailout to £50bn, more than the £45bn pumped in by taxpayers during its bailout. McEwan also warned of a “noisy” year to come in which the bank faces a multimillion pound penalty for the sale of mortgage bonds in the US in the run-up to the financial crisis, and another £1bn of costs to restructure the bank.

Its annual report also warned of the increased “economic and operational uncertainty” from the forthcoming referendum on Britain’s membership of the European Union.

“The result may also give rise to further political uncertainty regarding Scottish independence. RBS actively monitors, and considers responses to, varying EU referendum outcomes to ensure that it is well prepared for all eventualities,” said the Edinburgh-based bank.

Davies said the bank would be able to survive any economic downturn that followed Brexit and said the board had not been under any influence from the government in forming its view.

The senior executives at the bank, including McEwan, do not receive annual bonuses, in an attempt to defuse the rows over pay that have characterised RBS since its bailout. Other employees do, however, and that bonus pool was down 11% to £373m. McEwan’s pay included £1m of the allowances that have been put in place in the wake of an EU bonus cap, although he will give half of that to charity after acknowledging the bank still had more work to do.

The bank also disclosed a £2.1m payment to Stephen Hester, his predecessor who was forced out in 2013, from long-term pay schemes.

The annual losses were caused by £2.9bn of restructuring charges and £3.5bn of litigation and conduct costs. This included £334m relating to investigations into foreign exchange rigging, £157m for packaged bank accounts and £2.1bn related to mortgage bonds in the US.

Laith Khalaf, senior analyst at Hargreaves Lansdown, said RBS was the Jekyll and Hyde of the UK banking sector. “On the one hand the bank is downsizing, de-risking and cost-cutting, while at the same time conduct charges are playing havoc with overall profitability,” he said.

McEwan also set a new target to save £800m in 2016 that could result in some job cuts.

In legal warnings it outlined a string of potential worries, including an ongoing court case from investors who backed a cash call before its 2008 taxpayer bailout, court cases in the US involving Libor-rigging, cases accusing the bank of funding terrorists and the risk of court cases from business customers sold interest rate swaps. It also disclosed it would be writing to customers later this year to establish if they had been mis-sold pension and insurance products.

The fall in the shares took place after the bank admitted that its attempts to start making dividend payments to shareholders had been pushed back from the first quarter of 2017. This is because it needs to spin off 300 branches under the Williams & Glyn brand – a sale mandated by the EU following its bailout – and settle the US cases over the sales of mortgage bonds.

Even so, the bank is paying back the so-called dividend access share it sold to the government during the crisis, which prevented any shareholders receiving dividends before the government. This will cost more than £1bn to repay this year.

While the figures appeared to make it more difficult for the chancellor, George Osborne, to sell off the remaining stake in the bank, Davies said: “I do believe there is, at the core of this, a good profitable bank.” He said that while it was impossible to know if the government would get all its money back, it “will get quite a lot back”.

Lloyds Banking Group shares continued to rise – after its promise on Thursday of bigger returns for shareholders – to close the week at 72.1p, just below the 73.6p breakeven point for taxpayers.

[Source:- TheGuardian]