4 Ways to Avoid Running Out of Money in Retirement

Compared to the length of retirement, 15 minutes is no time at all. But that’s all you need to learn the basics of developing a plan to make your savings last as long as you need them. Still, many investors don’t take this time-putting their retirement in jeopardy.

Investors’ biggest errors often occur long before any buying or selling takes place. They tend to have poorly defined objectives, no real sense of their time horizon (how long they need the money to last) and don’t quite understand that any investment has risks and returns to consider.

To start, ask yourself how long you’ll need your retirement savings.

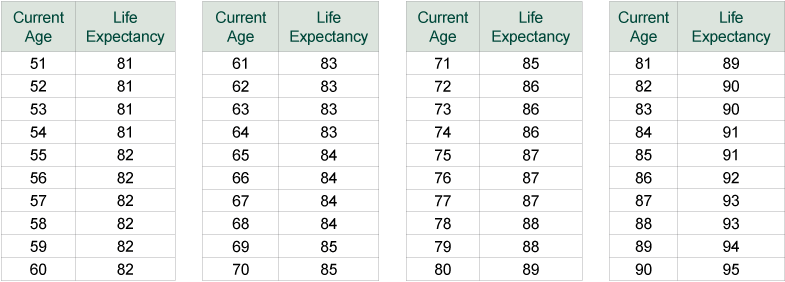

Most investors need their savings to last as long as they do-sometimes longer if they’d like their portfolio to support a younger spouse, children or charity after they’re gone. So exactly how long that could be for you isn’t black and white. Average life expectancies are published every year, but they can only tell you so much. After all, an average is the middle, and you probably aren’t “average.”

To get a better idea, consider your heredity-your family’s history of health and longevity. Be sure to consider advances in health care and technology. Merely because your father died at 70 doesn’t mean you’ll do the same. Most people outlive their ancestors, hence rising average life expectancies. Planning early for a longer life is smart.

You could also be underestimating the amount of cash flow you’ll need after retirement.

Maintaining your lifestyle becomes much more costly if your expenses are heavily tilted to categories of goods or services with fast-rising prices-like health care. Overall inflation has averaged about 3 percent annually — a retirement plan that doesn’t account for inflation has a significant hole.*

Our 15-Minute Retirement Plan can help get you get started on a successful path.

[source : dailyfinance.com]