Better banking ahead

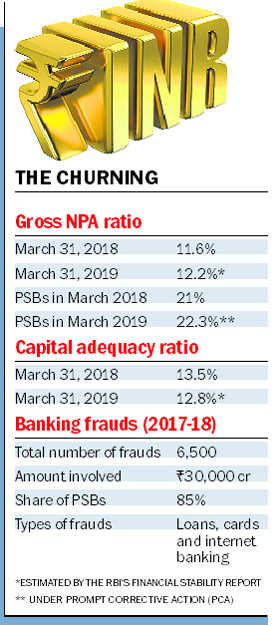

With major public sector banks posting hefty losses in the midst of rising non-performing assets, the process of cleaning up of balance sheets has reached the tipping point. Efforts to detoxify balance sheets of banks had begun in September 2015 with the asset quality review, followed by many asset quality improvement measures. Although the exercise has impacted their books, it will be eventually beneficial for them. These banks are in the process of strengthening their fundamentals. Already 11 out of 21 public sector banks (PSBs) are resuscitating under the prompt corrective action (PCA) doctrine. Restrictions on lending imposed on Dena Bank and limited restrictions on Allahabad Bank might impact their future businesses, but these measures are in the longer interest of ailing banks.Their woes have worsened further because of the RBI’s new stressed asset resolution framework that has led to the deterioration in asset quality with its attendant provisions on newly classified non-performing assets (NPAs). The rise in bond yields, a market phenomenon that increased mark-to-market (M2M) losses, has further enhanced the burden. Besides, the enhancement in gratuity ceiling from Rs 10 lakh to Rs 20 lakh called for additional provisions. Some banks also made provisioning for the next salary revision. Such factors contributed in varying proportion to the current poor state of performance of the PSBs, which could be temporary and, in fact, good as a one-time measure for their future sustainability. Once banks adjust to the new stressed asset resolution framework, they can prevent new NPAs. It may be disappointing for stakeholders to find so many banks in the red, but a deep dive into the reasons will convince that it is necessary to clean up the balance sheet once for all. The PSBs that can emerge out of PCA dictum will be in a better position to focus on new businesses in the years to come while recognition of NPAs will help in tackling them with appropriate tools. The RBI has made stressed asset resolution process IBC-centric for loans of Rs 2,000 crore and above from March 1, 2018. More banks will use the IBC to enforce recovery in future. Hence, the experience of resolution professionals (RPs) and Committee of Creditors (CoC) in dealing with National Company Law Tribunals (NCLTs) in the ongoing stressed asset resolution process in the first lot of 12 large NPA accounts is getting mapped. Moreover, based upon the recommendations a 14-member high-level committee, the Union Cabinet approved certain amendments to IBC now brought in force through the ordinance route. It has enabled residential flat owners to get the status of financial creditors; resolution plan can be withdrawn from the NCLT if 90 per cent of creditors agree; MSME borrowers will be able to bid for own firms and vote share among CoC members for approving resolution plan is down from 75 per cent to 66 per cent in critical decisions and to 51 per cent in routine decisions. These broad changes have the potentiality to make the stressed asset resolution seamless and bank-friendly. Better performance is expected in FY19. Against the deposit growth of scheduled commercial banks (SCBs) of 6.8 per cent during FY18, the credit growth could reach 9.5 per cent, indicating the revival of demand for credit. But the PSBs struggling with higher NPAs could post a credit growth of 4.7 per cent and deposit growth of 3.1 per cent, lower than the industry average. However, private banks could increase their deposit growth to 17.4 per cent and taking credit growth to 20.9 per cent. On the whole, the banks are set to improve their performance during FY19 due to revival of GDP growth to 7.5 per cent and stabilisation of the GST. Once PSBs are able to overcome the NPA mess sometime over the next two years, they can bounce back with normal growth rates.Therefore, keeping in view the long-term interest of the banking sector, benign performance in key parameters during FY18 should be considered as part of transformation phase of banking operations cleaning up their balance sheets. It will enable better banking in future.

[“Source-tribuneindia”]