Future banking and digital currency

In the middle of 2019, Facebook registered its global digital currency Libra and released its white paper, spelling out an audacious mission “to enable simple global digital currency and financial infrastructure that empowers billions of people”. The US government and regulators opposed it and refused approval for the launch of this project.

There are fears that Libra has the potential to threaten the supremacy of fiat currencies, including the US dollar. Facebook looks undaunted by the regulatory pushback and desertion of the consortium by members like Visa, Master and Pay Pal. The social media giant’s audacious move is a wakeup call to central banks to protect and preserve the sovereignty of money.

Contents

Limitations of Cryptocurrencies

Governments and regulators all over the world take a dim view of private cryptocurrencies, particularly for their potential misuse for money laundering and other illegal activities like drug trafficking, terror financing, tax evasion and corruption. Besides, they do not fulfil the three basic functions of money — a) unit of account, b) medium of exchange, c) store of value. It is not legal tender either.

Private cryptocurrencies have been in circulation for over a decade since the launch of Bitcoin during 2009 and despite the hype and noise, they could not bite into the fiat (official) currencies in terms of volumes. Bitcoin is limited to 21 million units and nearly 85% is utilised. It processes seven transactions per second (TPS) against card companies’ 24,000 per second. These cryptocurrencies suffer from limitations of scale and speed besides lack of sovereign backing and even hostility from central banks.

They are highly volatile. For instance, during Dec 2017-19, Bitcoin traded between US$ 3,440 and US$ 13,860 and this smells more like a casino/lottery ticket and not currency as a store of value. Cryptocurrencies are generated by complex and high power consuming computer systems and algorithms.

As against about 185 official currencies (recognised by UNO), private cryptocurrencies number over 3,000 and an equal number could not survive for long. But they could not pose real threat to official currencies except irritating regulators and governments. Many countries have outlawed cryptocurrencies. However, of late, a few countries are putting in place a regulatory framework and engaging with these cryptocurrencies.

Libra – A Stable Coin

Libra is a significant improvement over all other cryptocurrencies. Libra by design indicates that it has all the properties of money like unit of account, medium of exchange and store of value. It would be backed by reserve currencies, well accepted assets and pegged to the US dollar. The only missing element is, it is not official/sovereign currency and would not have the trust that goes with it.

Facebook has over 2.5 billion global user base and as such, it has a ready platform to make an active medium of exchange among its subscribers. This can impact banking and financial intermediation, payment systems and even stymie monetary and financial policies of the government. This has raised a hornet’s nest among governments and regulators.

Global Response

Many countries have been forced to actively combat the perceived threat that the imminence of Libra poses to the financial and economic systems. Former IMF chief Christine Lagarde has exhorted governments to fight fire with fire, implying they may launch their own official digital currencies. The IMF has come out with a lot of working papers/research work and is willing to help countries on policy framework.

Six leading central banks of the UK, European Union, Canada, Japan, Sweden and Switzerland are working under the aegis of Bank for International Settlements (BIS) to collaborate on research and share their experience. The World Economic Forum has launched a global consortium and even released a toolkit to guide central banks right from identification of use cases, risk assessment of each of the models to their implementation.

China Ahead

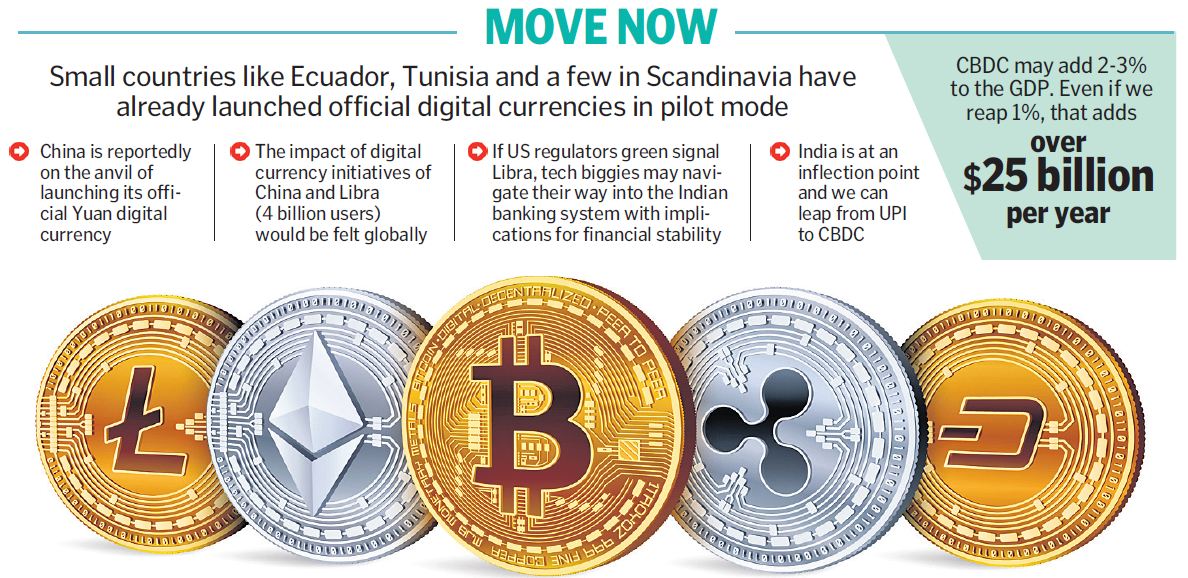

Small countries like Ecuador, Tunisia and a few in Scandinavia have already launched official digital currencies in pilot mode. To cap it all, China is reportedly on the anvil of launching its official Yuan digital currency and may be on a global scale as a settlement currency. Its huge population of 1.4 billion, with ubiquitous digital payment platforms, can transform its domestic as well global markets beyond recognition.

Incidentally, China was the first country to introduce coins, and again paper currency in 7th century and now official digital currency. Hat trick indeed! The impact of digital currency initiatives of China and Libra (4 billion users) would be felt globally.

Design Principles, Use Cases: CBDC

In simple terms, official digital currencies are representation of paper currency and a bit more. Access, Identification and Interest are the three basic design principles of a Central Bank Digital Currency (CBDC). A country may design CBDC depending on the use case and objectives.

Access: CBDC may be designed with universal access to the entire public (retail) or restricted to commercial banks/financial institutions (wholesale) or a hybrid model. The public may have direct digital currency account with the central bank or only deal with commercial bank. If it is wholesale functionality, the impact would be majorily on payment system and intermediation function would be retained. If the public is allowed to have CBDC with central banks directly, it may threaten banking intermediation and high-powered money and credit creation. People may prefer to keep CBDC with central banks if they fear for safety of the banks. Electronic money in a way represents wholesale model.

Identification: CBDC may have anonymity like paper currency or be identified like bank deposits. Governments generally would not like anonymity as it may lead to use of CBDC for illegal activities. Identification feature also enables quicker dispute resolution.

Interest: CBDC may be zero interest bearing like paper currency or interest bearing like bank deposits.

Monetary Policy, Financial Structure

If it is interest bearing, CBDC will have major implications for monetary policy, financial system and fiscal policies. The role of central bank as we know would radically change.

If this interest bearing functionality is combined with universal access, people may prefer to keep the digital money with central bank as it is much safer and remunerative than keeping with commercial banks. In such a scenario, the savings of people would gravitate towards central banks and CBDC would unwittingly become a substitute for bank deposits. Banking intermediation function gets highly impaired and central banks may have to lend to banks for onward lending to public or they directly lend to public/project/government. This would disrupt the present financial system and central banks are not equipped for financial intermediation function rather than as a lender of last resort. This needs new resources, redefining and rearchitecting central banks.

CBDC may become second monetary policy tool and money supply or interest may be varied by varying interest rates or quantity of money in supply respectively. For developed countries stuck with zero/negative interest rates, CBDC has a significant value proposition for monetary policy effectiveness and helps adjust demand/output gaps.

Japanese prefer to keep cash under pillows than to suffer negative interest rate by keeping savings with banks, thus thwarting government plans to induce people to spend and prop the sagging economy. CBDC with high negative interest rates may be helpful to induce people to spend. Quantitative easing (QE) may take a different shape and form and get more teeth with CBDC.

Besides these macroeconomic and prudential principles, the design will need to afford convenience, low cost, safety and 24X7 availability and reliability from the consumer’s perspective. They need strong defences against cyberattacks and outages.

In India

In India, Facebook has a monthly active user base of about 260 million and WhatsApp about 400 million. The UPI (Unified Payments Interface) has unique user base of only around 100 million. They are waiting in the wings for regulatory clearance for launch of payment system on the UPI platform. If this is combined with e-commerce integration and loaning and other financial services like insurance and mutual funds through tie-ups, it may threaten/disrupt the banking/financial system.

Google, Amazon, Apple and their ilk are not far behind. If US regulators give green signal to Libra, these tech biggies may navigate their way into not merely the Indian payment system but banking and finance with implications for financial stability. Financial inclusion and contribution to digital India mandate may be sweeteners to policymakers.

India’s Use Cases

India’s cash/deposit ratio at around 11% is among the highest, excluding Japan. The cost of printing to RBI and cost of logistics externalised to banks, merchants and others run to a couple of tens of thousands of crores.

The menace of corruption, tax evasion, use of money in elections, weak monetary policy transmission, fractional reserve problem of commercial banks, financial inclusion, formalisation of economy, high cost of printing currency and its logistics are some of the use cases in India’s context. With CBDC in place, may be the Modi government may go in for demonetisation of high value notes with least disruption and high and enduring impact. Massive circulation of currency, particularly of high value, is a public policy problem in many countries, including ours. CBDC may mitigate it.

Seigniorage profits arising out of high cash/deposit ratio are transferred to the government by the Reserve Bank of India (RBI) by way of dividend. At a broader economy level, this is almost a zero sum game besides adversely impacting efficiency of our financial system.

Accelerate CBDC Project

The government and policymakers appear to be moving at a snail’s pace. The government-appointed high-powered CBDC Committee (2017) headed by senior bureaucrats submitted a report in 2019. It suggested an open mind on these developments and constitution of another committee. We have the runaway success of UPI, a billion Aadhaar database and JAM (Jan Dhan-Aadhaar, Mobile phone) trinity. All these innovative projects are home grown at a fraction of global costs and globally acknowledged.

The RBI-appointed Nandan Nilekani committee has focused only on use case of CBDC, viz, digital payments. These developments no doubt are worthy but not adequate both in terms of scope and architecting a new operating structure friendly to official digital currency. Internet of money has well and truly arrived. We need to think beyond MDR (merchant discount rate) quarrels. We are at an inflection point and we can leap from UPI to CBDC. Some of the countries, including Singapore and Thailand, are reportedly experimenting CBDC.

Distributed Ledger Technology (DLT) is the popular platform but has limitations in the current form. A full-blown CBDC may run technology agonistic platforms.

Currency, whether physical or digital, is a public good of sovereignty and this may be compromised at our peril. As per some rough estimates, CBDC may add 2-3% to the GDP. Even if we reap 1%, that adds to over US$ 25 billion per year. There is a strong economic and social case for CBDC. We cannot afford to watch from the sidelines. We need to up the antenna and be ready with prototypes and even pilots in the next one/two years.

Printed currency served modern world for over 15 centuries. It deserves a break.

CBDC is a multiyear project but no longer a moonshot. When China’s CBDC provides acceptable global settlement, it may change geopolitics. China is ahead in the CBDC race and Libra is knocking at the door. We need more than an open mind and get into serious multi-disciplinary research. India needs to step on the gas on the CBDC project and leapfrog from UPI/Aadhaar, JAM to CBDC for inclusive growth.

[“source=telanganatoday”]