How China plans to lead the computer chip industry

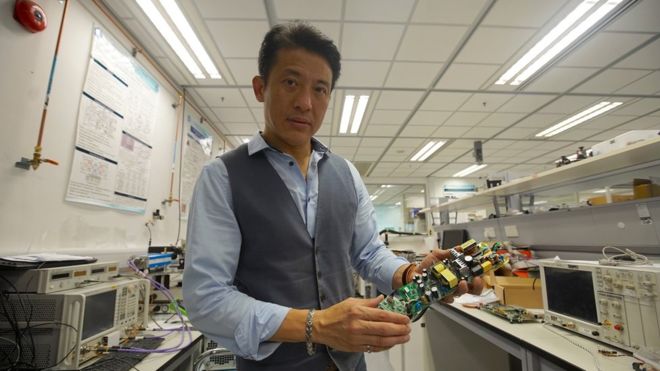

On a university campus on the outskirts of Hong Kong a group of engineers are designing computer chips they hope will be used in the next generation of Chinese made smart phones.

Patrick Yue leans back in his chair in a coffee shop on the campus, sporting a Stanford University t-shirt. He is the lead engineer and professor overseeing the project.

His research team designs optical communication chips, which use light rather than electrical signals to transfer information, and are needed in 5G mobile phones and other internet-connected devices.

He tells me about the challenges China faces in developing a world-beating computer chip industry.

“I actually think the actual designers will be as big a bottle neck as the manufacturing. We don’t have nearly as many research institutes and industry bases to train the designers,” he says.

His department is part-funded by Huawei, the Chinese communications and telecom giant at the centre of an international political storm.

In May the US added Huawei to a list of companies that US firms cannot trade with unless they have a licence, blaming security concerns.

Rivals is a season of in-depth coverage on BBC News about the contest for supremacy between the US and China across trade, tech, defence and soft power.

Many industry observers fear that the US-Chinese trade war, risks unravelling the global technology supply chain.

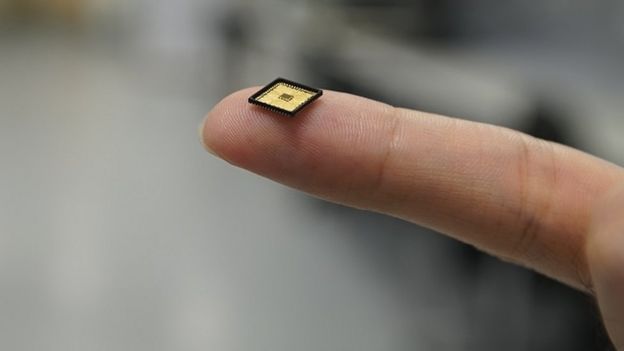

In particular, China relies on overseas companies for computer chips (or semiconductors), the tiny devices used in everything from consumer electronics to military hardware.

“Politically everything can be used as a bargaining power,” says Mr Yue.

“If these companies and countries start to hold back on technology then everyone will get hurt. It’s not good from a technological point of view,” Mr Yue says.

China has made no secret of its desire to become self-sufficient in technology. The nation is both the world’s largest importer and consumer of semiconductors.

It currently produces just 16% of the semiconductors fuelling its tech boom.

But it has plans to produce 40% of all semiconductors it uses by 2020, and 70% by 2025, an ambitious plan spurred by the trade war with the US.

Image copyrightGETTY IMAGES

Image copyrightGETTY IMAGESIn May 2018 China’s President Xi Jinping met with the country’s leading scientists and engineers, calling for specialists to work towards self-reliance in the production of core technologies.

That meeting was just a month after the US government banned US firms from selling components to ZTE, China’s second-largest maker of telecom network equipment.

The ban highlighted to China’s leaders that the nation’s tech boom was dependent on foreign technology.

In October this year, in its latest bid to help wean the nation’s tech sector away from US technology, the Chinese government created a $29bn (£22m) fund to support the semiconductor industry.

“There is no question that China has the engineers to make chips. The question is whether they can make competitive ones,” questions Piero Scaruffi, a Silicon Valley historian, and artificial intelligence researcher who works in Silicon Valley.

“Certainly, Huawei can develop its own chips and operating systems, and the government can make sure that they will be successful in China. But Huawei and other Chinese phone makers are successful also in foreign markets, and that’s a totally different question: Will Huawei’s chips and operating systems be as competitive as Qualcomm’s and Android? Most likely not. At best, it will take years before they are,” Mr Scaruffi adds.

Mr Scaruffi estimates that China could be as many as 10 years behind the leading producers of high-end computer chips. The majority of chips made for high-end electronics are manufactured by specialist foundries like the Taiwanese Semiconductor Manufacturing Company (TSMC). It produces more than 70% of chips designed by third party companies.

Just securing the best machinery needed to make high-end chips is difficult.

“To start out with equipment, its very high precision equipment. You need to print very fine features. The equipment that is needed to have this kind of technology is controlled by a few companies in the world,” says Mr Yue.

He believes that Chinese technology is three to four generations behind companies like TSMC. China lacks the industry experience to manufacture high end chips, he says. But he believes that companies like Huawei are already competitive when it comes to designing chips.

Image copyrightGETTY IMAGES

Image copyrightGETTY IMAGESWhere does this leave the tech giant Huawei?

Mr Yue argues that Huawei is trying to replicate the successful business models of firms like Samsung, which produces its own computer chips – rather than trying to fall into line with Beijing’s industrial ambitions.

“You can almost view them as an integrated company with the expertise of what Apple or Qualcomm has,” says Mr Yue.

Li Changzhu is a lifelong employee of Huawei and president of the company’s handset business. He joined the company 23 years ago as a fresh graduate and has watched it grow into the international tech giant. He claims that the goal of companies like Huawei is simply to satisfy consumer needs.

“We are open to use other vendors chipsets. Every year we purchase a lot of chips from Qualcomm. We are open to that. We use the best chipsets to satisfy our customers,” he says sitting on the side of a tech conference in Macau, a semi- autonomous southern Chinese city.

Growth in the semiconductor industry is typically driven by disruptive new technologies. In the late 2000s the introduction of smartphones boosted demand for the tiny integrated circuits that control everything from memory to Bluetooth and wifi.

But today China’s ambition to dominate sectors such as artificial intelligence and 5G is expected to further ramp up demand for high-end chips.

Industry analysts like Mr Scaruffi question China’s ability to truly innovate. “Every Chinese city wants to build its own Silicon Valley. It tends to be more driven from the top. Silicon Valley had a big advantage, that it was very far away from the political power,” says Mr Scaruffi.

He believes that China’s technological success lies in the implementation of technology rather than its creation.

“If your metric is how many people use smart phones to go shopping then China wins big time. But if your metric is Nobel Prize winners, then China is losing badly. China of course has been very successful in implementing technology in a way that dramatically alters society,” he says.

[“source=bbc”]