California Sues Betsy DeVos Over Student Loan Forgiveness

California just sued U.S. Secretary of Education Betsy DeVos over student loan forgiveness.

Here’s what you need to know.

Contents

Student Loan Forgiveness

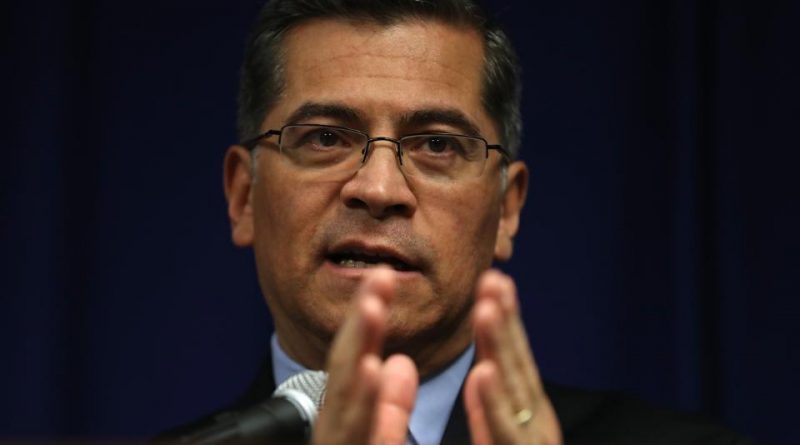

California Attorney General Xavier Becerra announced today a lawsuit against DeVos and the U.S. Department of Education for its alleged failure to implement a student loan forgiveness program called Temporary Expanded Public Service Loan Forgiveness (TEPSLF). This program is an offshoot of the Public Service Loan Forgiveness program, which helps student loan borrowers who work for a qualifying public service or non-profit employer receive federal student loan forgiveness. The TEPSLF program provides student loan forgiveness for borrowers who sought public service loan forgiveness, but were rejected because they selected a student loan repayment plan that was ineligible under the program.

“College graduates who put in a decade of hard work and made timely payments on their student loans earned their TEPSLF loan forgiveness,” Becerra said. “But Education Secretary Betsy DeVos chose to ignore all of that. Today’s lawsuit reminds Secretary DeVos that she is not above the law. She is accountable to these college graduates who followed the rules and deserve better, especially amidst an economic crisis of historic proportions.”

Student Loan Forgiveness Statistics

The latest student loan forgiveness statistics show that more than 98% of borrowers have been rejected for public service loan forgiveness. As of April 2020, out of 150,545 borrowers, 2,215 borrowers collectively have received $146 million in public service loan forgiveness. That’s less than a 1.5% approval rate. The average student loan balance discharged was $66,066. Another 1,826 requests have been approved under the Temporary Expanded Public Service Loan Forgiveness Program. Of this total, 1,310 borrowers have received $56 million of student loan forgiveness. The average student loan balance discharged under TEPSLF is $42,943

Student Loan Forgiveness: Background

The Public Service Loan Forgiveness Program is a federal program that forgives federal student loans for borrowers who are employed full-time (more than 30 hours per week) in an eligible federal, state or local public service job or 501(c)(3) nonprofit job who make 120 eligible on-time monthly payments. In 2018, Congress created TEPSLF to help fix various issues with public service loan forgiveness and grant more student loan forgiveness to borrowers. Becerra alleges that has not necessarily been the case. According to Becerra, Congress instructed the Education Department to simplify and expand the program to increase the rate of student loan forgiveness. This was supposed to include a “simple” application method within 60 days. Now, two years later, Becerra claims that the Education Department has mismanaged the program.

Student Loan Forgiveness: The allegations

Becerra alleges that the Education Department did not implement the TEPSLF on a timely basis and made the process to apply complex. Becerra also alleges that the Education Department violated the Administrative Procedure Act. This is not the first time Becerra has sued DeVos over student loan forgiveness:

- In October 2018 and August 2019, Becerra asked DeVos and Federal Student Aid Acting Chief Operating Officer Jim Manning to address the 99% denial rate for Public Service Loan Forgiveness applications.

- In March 2020, Becerra sued the Education Department over the Gainful Employment Rule, alleging that the Education Department’s decision to repeal the rule hurt federal borrowers.

- In May 2019, Becerra called on DeVos to develop an automatic student loan discharge program for disabled veterans.

- In June 2018, Becerra sued Navient for allegedly misleading student loan borrowers, engaging in illegal collections practices and steering borrowers to more costly repayment options.

- In December 2017, the Attorney General filed a lawsuit against the Education Department and DeVos for failing to grant promised loan relief to tens of thousands of students allegedly defrauded by for-profit schools operated by Corinthian Colleges.

The Education Department has not publicly commented on the lawsuit.

How to pay off student loans faster

There are many options for student loan repayment, even if you’re not pursuing public service loan forgiveness. What’s the best way to pay off student loans faster? Start with these four options, all of which have no fees:

- Student loan refinancing

- Student loan consolidation

- Income-driven repayment plans

- Student loan forgiveness

source: forbes