Goldman Sachs warns about US companies’ emerging market exposure as Turkey crisis flares up

Sales at U.S. companies with significant emerging market exposure posted a notably weak financial quarter, according to Goldman Sachs, amid a growing crisis in Turkey as well as ongoing trade and tariff woes with China.

Of Goldman’s emerging market stock basket – which includes companies with sales in Brazil, Russia, India and China – only 47 percent of companies in the basket posted positive earnings surprises. The broader S&P 500, meanwhile, posted a “stellar” season with the fastest earnings per share growth (25 percent) and the highest percentage of positive earnings per share surprises in seven years.

Emerging markets fell again Monday as the Turkey crisis strengthened the U.S. dollar and caused investors to flee to the safety of developed markets. While these U.S. companies cited by Goldman don’t necessarily have direct exposure to Turkey, if money starts to flee emerging markets, their sales could suffer.

There are signs that is already happening.

“Fully 23 percent of the stocks in the basket missed consensus sales estimates by more than one standard deviation, nearly double the percent of negative surprises in the S&P 500,” wrote David Kostin, Goldman’s chief equity strategist. “At the macro level, portfolio managers are attempting to handicap the outcome of trade negotiations and the timing and magnitude of tariffs.”

The basket of so-called BRIC companies has underperformed the broader S&P 500 by 250 basis points so far this year, he added.

Components of Goldman’s emerging markets list include Wynn Resorts and Las Vegas Sands, both of which have more than 70 percent sales exposure to BRIC countries.

Financial companies like Citigroup and Morgan Stanley generate 35 percent and 12 percent, respectively, of their sales from Brazil, Russia, India and China, according to Goldman Sachs.

The bank’s cautious note came as the Turkish lira continued its downward spiral Monday with a 7 percent drop after plunging roughly 20 percent against the dollar Friday.

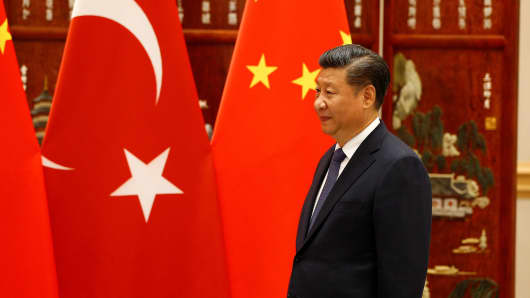

A growing diplomatic dispute between Ankara and Washington over the release of evangelical pastor Andrew Brunson sparked President Donald Trump to authorize the doubling of metals tariffs against Turkey on Friday, exacerbating a swoon in global securities.

The Russian ruble and markets remain battered after fresh U.S. sanctions over Moscow’s alleged poisoning of a former spy in Britain. Fears of further sanctions pushed the ruble down 3 percent Wednesday, while the dollar hit its highest level against the Russia currency since November 2016 on Thursday morning.

Russia’s dollar-denominated RTS, an index of 50 Russian stocks traded on the Moscow exchange, is down 7.2 percent over the last five trading days.

Economic ties between the U.S. and China remain stressed after the Chinese Ministry of Commerce announced a 25 percent charge on $16 billion worth of U.S. goods on Wednesday.

“A strong U.S. dollar represents a potential headwind to firms with the highest foreign sales exposure, as their goods and services become more expensive relative to goods and services within the foreign country,” Kostin wrote last month. “As a whole, tariffs will weigh on S&P 500 earnings in two ways: lower export revenues and lower margins resulting from higher input costs.”

The 333 goods targeted in the current round of tit-for-tat tariffs represent just the latest step in a series of trade fights between the two nations. Many analysts have suggested that the impact of the Washington-Beijing war could spiral out of hand if a prolonged conflict hampers business confidence and leads to derivative supply chain disruptions.

“The rise in U.S.-China trade tensions have raised concerns about the strength of external and domestic demand in (the second half of 2018) via direct and indirect effects on services such as logistics, wholesale trade, and trade finance, as well as on business sentiment and investment,” J.P. Morgan analysts wrote in July.

[“source=ndtv”]