It’s not just about saving. Teach your teen to invest now to set them up for a financially healthy life

Teaching kids how to save is a valuable first step toward learning how to manage money. But it shouldn’t stop there. While savings accounts are a safe bet and an easy concept to grasp, the real earning power comes from investing their hard-earned cash.

That’s because kids possess a very powerful gift: time. The earlier your child starts investing his or her money, the greater the rewards are later. That’s due to the magic of compounding, wherein the gains continue to grow, because each year money is made from the previous year’s profits.

For instance, if $100 is invested in the S&P 500 and it gains 10% in a year, that holding will be worth $110 by year’s end. After another year and another 10% gain, it’s worth $121. After a third year it’s $133.

According to CNBC’s “Mad Money” host Jim Cramer, with that 10% average annual return, an investor can double his money in about seven years.

“The magic of compounding works best the younger you are, because that means you have more time for your money to grow,” he told CNBC viewers on his show.

But can kids really grasp the concepts of investing?

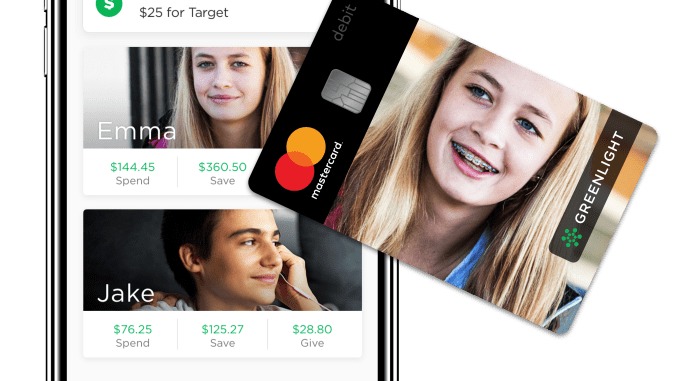

Tim Sheehan, co-founder and CEO of Greenlight, the teen-focused digital banking company that provides parent-managed debit cards for kids, says they absolutely can. “Kids will surprise you with how much they will understand and how much they can do,” he said. “If you start with very simple things like relating it to products or services they use, you can explain the high-level concept of investing to most kids.”

Greenlight’s approach to teaching kids money-management skills is working: To date more than 700,000 families are using its app-based service, which provides customers three accounts in one: a spending account, savings account and giving account so kids can donate to a charity. Now the company is about to launch its investment account feature, encouraging kids as early as 10 years of age to research and invest in stocks with parental supervision.

“I think teens are interested in learning. They don’t want it to be something they read from a book. If they can learn by doing, they will adopt it and they will actually learn the key things you want them to learn,” said Sheehan.

“To build true wealth, you do that through investing,” he said. “You don’t really build wealth with a savings account. The earlier you begin to teach and prepare your kids, the more time they have to learn, ask questions and make mistakes in a safe and supervised way. And if you learn to do it properly and do it well,” he said, “it can make life easier.”

Greenlight is not the first kid-focused financial platform aiming to help parents introduce their kids to investing. In 2017 BusyKid partnered with Stockpile to become the very first chore/allowance platform that allows kids to use their allowance to purchase real stock. Today 45,000 kids are using the platform.

“We target kids 5 to 15,” says BusyKid co-founder and CEO Gregg Murset. “That decade is the most crucial to teach kids and lay a good foundation for them. After teaching your kids not to lie and cheat, money skills are the best things we can give them, because this sets them up for a better future.”

Murset is a certified financial planner and leading advocate for sound parenting, child accountability and financial literacy. As a father of six, he points to the strides his two teen sons are making in the world of stocks thus far. “One of my sons bought Disney stock because he likes Disney movies; the other bought Ford because he likes pickup trucks. They both know exactly what they are trading at, exactly what they bought it at, they both know what their gain is or loss is, and they like to rub it in each other’s faces, which I think is fantastic. If you can start it at an early age, you really just start something growing within them that’ll lend to a lot of good decision-making in the future.

“Imagine what they are going to do if they have some experience in stocks and investing in their teen years and they get their first job and get offered a 401(k) and have investment options and even a company match. They’ll know what it’s about. Imagine the impact that has 40 years down the road when they go to retire. Huge,” said Murset.

He cautions, however, that pushing your child to invest in something they aren’t passionate about is “a waste of time. I let them invest in small increments in something they care about or they think is cool.”

Here are some additional tips from Greenlight’s Sheehan.

5 ways to introduce investing to your teen

1. Explore investing as a family to teach the keys to long-term wealth. Work with kids to pick stocks of companies whose products and services they understand and use. Encourage them to research the companies to understand what they do. Together, look at their performance now and discuss how it might change in the future.

2. Teach them that investing is about the long term. Encourage kids to invest only money that they don’t need in the short term, because most successful investors take a “buy and hold” approach to investing. Share stories and books about successful long-term investors like Warren Buffett and Peter Lynch.

3. Start small and learn from mistakes. Show kids the power of investing with a small sum of money so they can make mistakes and learn from them without it costing a large amount. Some investing resources allow you to invest in fractional shares, lowering the risk and barrier to entry

4. Invest in something you care about. Encourage kids to invest their money in something they care about, as they will be more interested in following their investments and watching their money grow. You can also explain that many people invest in index ETFs and “index mutual funds – which invest in all of the companies included in a specific index, like the S&P 500.

5. Make it a habit. When kids earn or receive money — whether from gifts, allowance or chores — encourage them to invest a portion of it, because it will help them build the healthy financial habit of saving and investing.

“We need to change the mindset of this next generation. Student loan debt is at an all time high, consumer debt is at an all-time high, national debt is at an all-time high. I think we really need to change the way we do this with the next generation or we’re in big trouble,” said BusyKid’s Murset.

Sheehan agrees: “Raising a financially smart generation can lead to a healthier generation — one with less financial stressors — which allows everyone to reach their full potential. Imagine what that world would be like.”

[“source=cnbc”]